穆迪投资者服务公司 发表评论(0) 编辑词条

- 穆迪投资官方网站网址:http://www.moodys.com/ (英文)

- 穆迪中国官方网站网址:http://www.moodys.com.cn/ (中文)

穆迪投资者服务公司简介编辑本段回目录

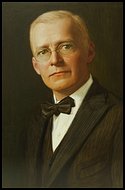

穆迪投资者服务公司(Moody's Investors Service)由约翰·穆迪于1909年创立。约翰·穆迪在1909年首创对铁路债券进行信用评级。1913年,穆迪开始对公用事业和工业债券进行信用评级。穆迪公司的总部设在美国纽约,其股票在纽约证券交易所上市(代码MCO),穆迪公司是国际权威投资信用评估机构,同时也是著名的金融信息出版公司。

穆迪投资者服务公司现已在12个国家开设了15个分支机构,投资信用评估对象遍布全球。穆迪公司已先后对100多个国家的政府和企业所发行的10万余种证券进行了信用分析与评估。目前,阅读和使用穆迪所发布的各类信息的客户已达1.5万余家,其中有3000多家客户属于机构投资者,他们管理着全球80%的资本市场。高级雇员总数达1500人,其中有680人为专业评估分析师。

1975年 美国证券交易委员会(SEC)认可穆迪公司、标准普尔、惠誉国际为“全国认定的评级组织”或称“NRSRO”(Nationally Recognized Statistical Rating Organization)。

穆迪中国编辑本段回目录

穆迪于2001年7月在北京设立代表办事处,开拓中国业务。穆迪于2003年2月成立全资附属公司—北京穆迪投资者服务有限公司,由穆迪负责中国金融市场的董事总经理叶敏先生出任主管。

穆迪公司已招聘了大量本地人员,现正在中国申请国内评级执照。穆迪为中国开发了国家级评级,为中国国内的债务资本市场投资者提供有关中国发行人及债务工具信用质量的意见。

穆迪亦提供信用风险资料及管理服务。其他在中国的非评级业务活动包括信用培训及信用风险管理咨询、软件工具及系统开发与服务。

展望未来,穆迪预计中国在结构融资、企业融资及金融机构等穆迪的三个主要业务领域内最终会出现强劲增长。此外,穆迪预期其信用分析及信用风险管理专业意见及系统在中国亦需求可观。

基于市场欣赏穆迪独到的评级、穆迪专有分析技术的价值,以及穆迪与客户建立更深厚关系及预期市场发展的能力,穆迪对发展中国业务一直兴趣浓厚。

Moody's Ratings 编辑本段回目录

Long-Term Obligation Ratings

Moody's long-term obligation ratings are opinions of the relative credit risk of fixed-income obligations with an original maturity of one year or more. They address the possibility that a financial obligation will not be honored as promised. Such ratings reflect both the likelihood of default and the probability of a financial loss suffered in the event of default.

- Investment grade

- Aaa

- Obligations rated Aaa are judged to be of the highest quality, with minimal credit risk.

- Aa1, Aa2, Aa3

- Obligations rated Aa are judged to be of high quality and are subject to very low credit risk.

- A1, A2, A3

- Obligations rated A are considered upper-medium grade and are subject to low credit risk.

- Baa1, Baa2, Baa3

- Obligations rated Baa are subject to moderate credit risk. They are considered medium-grade and as such may possess certain speculative characteristics.

- Speculative grade

- Ba1, Ba2, Ba3

- Obligations rated Ba are judged to have speculative elements and are subject to substantial credit risk.

- B1, B2, B3

- Obligations rated B are considered speculative and are subject to high credit risk.

- Caa1, Caa2, Caa3

- Obligations rated Caa are judged to be of poor standing and are subject to very high credit risk.

- Ca

- Obligations rated Ca are highly speculative and are likely in, or very near, default, with some prospect of recovery of principal and interest.

- C

- Obligations rated C are the lowest rated class of bonds and are typically in default, with little prospect for recovery of principal or interest.

- Special

- WR

- Withdrawn Rating

- NR

- Not Rated

- P

- Provisional

Short-Term Taxable Ratings

Moody's short-term ratings for taxable securities are opinions of the ability of issuers to honor short-term financial obligations. Ratings may be assigned to issuers, short-term programs or to individual short-term debt instruments. Such obligations generally have an original maturity not exceeding thirteen months, unless explicitly noted.

Moody's employs the following designations to indicate the relative repayment ability of rated issuers:

- P-1

- Issuers (or supporting institutions) rated Prime-1 have a superior ability to repay short-term debt obligations.

- P-2

- Issuers (or supporting institutions) rated Prime-2 have a strong ability to repay short-term debt obligations.

- P-3

- Issuers (or supporting institutions) rated Prime-3 have an acceptable ability to repay short-term obligations.

- NP

- Issuers (or supporting institutions) rated Not Prime do not fall within any of the Prime rating categories.

- Note: Canadian issuers rated P-1 or P-2 have their short-term ratings enhanced by the senior-most long-term rating of the issuer, its guarantor or support-provider.

Short-Term Tax-Exempt Ratings

Unlike S&P, Moody's has separate categories for short term munis. The ratings categories largely overlap, though, and have the same implications for the ability to repay short-term obligations.

Moody's History编辑本段回目录

The credit-rating business was the creation of a young man who got his start at a Wall Street bank in 1890 as an errand boy for $20 a month.

Dreaming of becoming a millionaire, John Moody had an epiphany one morning while reading the newspaper. With so little known about a growing number of corporate securities, someone was bound to publish an industrial manual offering financial information to investors. "When it comes," he recalled thinking in his autobiography, "it will be a gold mine."

In 1909, Moody started mining. He published a book about railroad securities, using letter grades to assess their risk. Investors looking for more certainty liked the idea, and the Moody business took off. So did Poor's Publishing Co., which began rating corporate debt in 1916, according to its successor company, Standard & Poor's. Standard Statistics Co. followed suit in 1922. Fitch entered the rating business in 1924.

In the ensuing decades, corporate America has increasingly turned to credit raters to smooth the way for its loans. As recently as the 1980s, companies did about half of their borrowing from banks. Now, the vast majority comes from the debt markets, which offer lower rates.

Over the past 30 years, the credit raters have also made significant inroads overseas, rating sovereign governments. In the 1970s, S&P rated only the United States and Canada; Moody's Investors Service added a third, Australia. None was a risk. That began to change when sovereign ratings took off in the 1980s and 1990s. By the year 2000, the major companies were rating about 100 nations each.

By most measures, the influence of the rating companies has continued to grow along with the size of the market for bonds and other debt, which is about $52 trillion worldwide. In the United States alone, about $21 trillion in debt was in the market in 2003 -- about 50 percent more than the value of all shares of stock being traded in the U.S. markets -- and almost none of that money could flow without a rating.

Today, as many as 150 credit rating agencies operate worldwide. But effectively, only two -- possibly three -- matter.

Wall Street confirms this fact when brokers buy or sell a bond for a client. When they call up the issue on the computer screen, the screen almost always has only two or three spots for credit ratings. Investors expect ratings from Moody's and S&P, each of which controls about 40 percent of the market. "You basically have to go to Moody's and S&P," said Dessa Bokides, a former Wall Street banker. "The market doesn't accept it if you don't go to both of them."

Third-ranked Fitch Ratings, which has about a 14 percent market share, sometimes is used as an alternative to one of the other majors.

"You're talking about an oligopoly," said Lawrence J. White, a former bank regulator and now economics professor at New York University's Leonard N. Stern School of Business. "Somebody who wants to buy wheat in the wheat market has a whole lot more choice than someone who wants to get a rating on a bond. There's three to choose from, and if you need more than one [rating], then you have to select two out of three, which in essence means you have one degree of freedom."

参考文献编辑本段回目录

- Alec Klein - Smoothing the Way for Debt Markets

附件列表

→如果您认为本词条还有待完善,请 编辑词条

词条内容仅供参考,如果您需要解决具体问题

(尤其在法律、医学等领域),建议您咨询相关领域专业人士。

0

标签: 穆迪投资者服务公司 Fitch Ratings New York University's Leonard N. Stern School of Business Standard & Poor's 信用评级 信用风险 信用风险管理 惠誉国际 机构投资者 标准普尔 纽约证券交易所

同义词: 暂无同义词

关于本词条的评论 (共0条)发表评论>>

编辑实验

创建词条

编辑实验

创建词条