美国经济史 发表评论(0) 编辑词条

美国经济史 编辑本段回目录

2 殖民地时期

3 新的国家

4 成长与扩展

5 美国内战和19世纪60年代的重建

6 黄金年代: 1870年代至1890年代

7 进步时代: 1890年代至1920年代

8 咆哮的二十年代: 1920年至1929年

9 经济大萧条: 1929年至1941年

10 战时管理: 1941年至1945年

11 战后经济:1945年–1973年

12 20世纪70年代:通货膨胀的灾难

13 撤销管制:1974年–1992年

14 新经济时期: 1990年代至今

15 统计数据

16 脚注

17 参考资料

17.1 数据

18 参看

【前殖民时期】

在欧洲人来到美洲之前,当地土著居民与外界鲜有贸易来往。以伊洛魁人为例,他们的经济以狩猎采集和农业为基础。而在欧洲人来到美洲后,当地土著居民保有的经济体制从此被殖民者带来的欧洲货品,火器,皮草贸易以及后来的战争,疾病,原著民土地的流失等深远的改变了。

公元1492年, 克里斯托弗·哥伦布在西班牙皇室的赞助下启航寻找通往亚洲的新航道,却意外的发现了“新大陆”。随后的一百年中,英国,西班牙,葡萄牙,法国和荷兰等国的探险家们先后来到新世界寻找财富荣耀,和推广宗教。不过北美的荒地起初未曾给这些探险家们很多黄金和荣耀,于是他们中许多人陆续的退出了这一事业。而北美真正意义上最初建立殖民地的一批人在随后来漂洋过海来到新大陆。公元1607年,一小股英国殖民者在现弗吉尼亚州的詹姆斯镇建立了英国在北美最初的永久性聚居地。

【殖民地时期】

在1770年,马萨诸塞州的航运枢纽—塞勒姆船舶现场

美国独立战争时期的漫画,显示美国正在锯掉一头牛的角(象征同英国商业关系的断裂) ,一个苦恼的英国人正在观看,其他的欧洲列强等着去挤奶。这幅漫画代表了美国在独立战争时期的经济状态。早期的移民者有许多不同的原因来到美国。马萨诸塞州的清教徒想在新英格兰创建一个纯洁的宗教。其它移民者,比如说佛吉尼亚, 主要的为了商业投机。英格兰在扩大殖民地的成功以致于后来成为美国,是因为大量的使用特许持证公司。 特许公司是由一群股东(通常是商人和富有的农场主)构成,他们追求个人经济利益而且有时还会服务英国国家利益。尽管它们作为金融私有的公司,英国国王为每个项目颁发了特许状或者经济特权以及政治和司法许可。各殖民地通常不会短期内看到回报,但是英国投资者会把他们的特许权转让给本地居民。这样做的政治影响深远,尽管当时少有察觉。各殖民地开始建立自己的生计,社区和独立的经济。

殖民地早期的繁荣归功于毛皮贸易,但是在殖民地中,人们主要是居住在自给自足的小农场。而在少数一些小城市以及南卡罗来纳和弗吉尼亚的些大型种植园里,一些生活必需品和几乎所有的奢侈品都通过出口烟草,稻米和靛蓝来得以交换。

支持性产业随着殖民地的扩张而不断发展,各种各样的专用锯床和磨坊开始出现。殖民地居民开始建立造船厂,同时制造渔船队和商船。他们也建立小型冶炼厂。到了18世纪,局部的发展模式变得清晰:新英格兰殖民地居民依靠造船和航运来积累财富;马里兰,弗吉尼亚和南北卡罗来纳的种植园(其中不少使用奴隶),主要种植烟草,水稻和靛蓝;中部的殖民地如纽约,宾夕法尼亚,新泽西和特拉华主要经营作物和毛皮的航运。这个时期,除了奴隶之外,殖民地居民的生活水平越来越好,甚至超过了英国。而由于英国投资者的离开,土地开始向殖民地企业家开放。

从詹姆斯一世开始(1603–1625)就受控于英国的北美殖民地,在1770年时已经在政治经济两方面做好了加入一场新兴的自治运动的准备。争吵最早出现在与英国的税收和其他方面;美国人希望修改税收和法令来满足他们对自治的要求,但是一部分人认为,越来越多的争吵最终将引发一场抵抗英国统治,谋求殖民地独立的战争。

崛起的中产阶级借用了洛克的《再论公民政府》中的一句话“生命,自由,财产是不可剥夺的权利”作为自己的口号。和在17世纪18世纪的英国政局动荡中一样,中产阶级在政治和经济两个方面坚定的支持着美国革命。

虽然政治上的分裂,也许并不是殖民地居民的原始目的,但是独立并且创造一个新的国家——美国,却成了事情的最终结果。

【 新的国家】

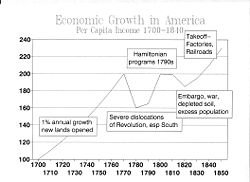

图1:1700年至1850年经济走势1789年的美国宪法确定了在州际之间的商业贸易没有关税,整个国家是一个统一联合的整体。在对联邦的权利范围的讨论中,第一任美国财政部长亚历山大·汉密尔顿持有一个很宽松的界定。汉密尔顿利用国债建立了强大的国家信用,这些国债被贵族们持有(因为贵族们有利益驱动将国家保持在健康的状态下),并利用进口关税作为担保。汉密尔顿相信国家能通过分散投资船运业,制造业和银行业来实现经济增长。他提议征收保护性关税来为政府支出买单,然而西部的农民很不满政府征收威士忌税。1791年他从国会得到特许,成立了美国第一银行,有效期至1811年。

托马斯·杰斐逊和詹姆斯·麦迪逊反对建立一个极权中央政府(相应的也反对汉密尔顿大多数的经济政策),但他们无法阻止汉密尔顿,因为当时汉密尔顿在华盛顿管理层里有着很大的权力和政治影响力。到了1801年,杰斐逊当选总统之后,开始推行一个分散的土地式民主(agrarian democracy),被称为杰斐逊式民主(Jeffersonian democracy)。其理念是保护普通民众免于政治和经济上的暴政。他称赞小农们是“最有价值的公民”。在他之后的麦迪逊总统让银行特许证于1811年到期,但在美国经济走下坡路之后,于1816年成立美国第二银行。

【成长与扩展】

第一台轧棉机 (对1869年的复原图)

棉花在开始时只是小规模的在南部种植,后来由于艾里·惠特尼(Eli Whitney)发明了轧棉机,可以将原棉和种子以及其他废物分开。所以棉花开始大规模种植。因为棉花的种植,一些使用奴隶的大型种植园让一些家庭变的非常富有。

数以千万计的移民向更加肥沃的美国中西部迁移。官方建立的国道和水路如“坎伯兰大道”和“伊利运河”帮助大量移民向西部迁移并且将大量的农产品运往市场。自由党人支持克莱的美国系统,它主张进行内部改进(道路,运河,港口)保护工业,并且建立一个强大的国家银行。然而,自由党人的立法程序被民主党人阻止了。

伊利运河在罗克港的景象(W. H. 巴特利特,1839年)总统安德鲁杰克逊( 1829年至1837年)反对美国第二银行,因为他认为美国第二银行有利于他的敌人的既得的利益。在杰克逊第二次当选为美国总统的任期内,他拒绝恢复银行的特许权并获得了国会的支持。杰克逊反对使用纸币,并要求向政府支付黄金和白银硬币。1837的恐慌使得经济停止增长达三年之久。

铁路是经济增长的重要贡献之一。 关于铁路是否是“必不可少”的,有许多截然不同的观点,但毫无疑问铁路是非常重要的。铁路为经营大规模商业运作的新的发展铺平了道路,创造了一个为未来商业所使用的蓝图。他们首先遇到管理的复杂性,工会问题及竞争问题。由于这些彻底的革新,铁路成为首个大规模商业企业。

恐慌被没有对在19世纪经济快速成长的美国造成太大的影响.相对而言;对于美国人口成长,快数发展的农场及工业发展仍然相当稳定.当交通建设的改善和新市场的持续扩张;新的发明以及资本的投资,仍旧驱使著美国经济引擎推动.蒸气船的发明使得船运更加的方便及便宜;但是铁路的发展所带来的影响更加全面性.不像是其他的交通运输,铁路在发展的期间受到了政府的许多支援,例如土地征收以及开山辟路,隧道工程...等等.并且得到了许多的民间及一些欧洲企业的私人资助.

有一些人一夜致富但是大多数人却失去毕生积蓄 然而愿景以及海外资金,结合了黄金的发现以及对美国公共利益及私人财富的承诺. 使这个国家有能力发展大规模铁路运输系统,奠定日后工业化的基础.

1864年,宾夕法尼亚州的钻石油的工厂

阿拉巴马州正在犁地的佃农(1937)18世纪,工业革命从北方开始,到19世纪初期时,迅速席卷了整个美国。

到19世纪中叶,尽管海上贸易通道仍被英国皇家海军的炮舰外交主宰,但是美国的购买力水平已经超过沙俄、普鲁士,并几近与法国或印度相平。

到1860年, 阿伯拉罕·林肯任总统期间,16%的美国人口居住在城市,而且全国三分之一的收入来源于制造业。城市工业起初仅限于东北部地区;棉布生产占据首要位置,制鞋业、毛纺生产和机械制造也在扩张。许多新的工人都是移民。从1845年到1955年,每年大约有30万欧洲移民来到美国。他们中的很多都是穷人,留在了东部的城市,并且往往是他们刚到达时所在的港口城市。

而另一方面, 依然是农业地区的美国南方,对北方存在着资本和制造业商品上的依赖。 南方的经济利益, 包括奴隶制的保有, 只有在南方控制联邦政府的前提下才能收到政治力量的保护。1856年建立的共和党,代表着工业化的北方。1860年, 共和党和他们的总统候选人阿伯拉罕·林肯在奴隶制上持观望态度,但在经济政策上就坚定得多。1861年, 他们成功地出台了保护性的关税政策。1862年, 第一条太平洋沿岸的火车线路被特许设立。1863年,一个全国性的银行系统建立,用以资助美国南北战争;每个城市都设立了“第一国家银行”,有些依然存留至今。

美国北方在工业化程度上对南方的的优势确保了其在美国南北战争(1861–1865)中的胜利。北方的胜利决定了美国的未来及其经济体制。奴隶制的废除,使得南方的棉花大种植园收益锐减。在战时和战后迅速扩张的北部工业则继续迅猛发展。工业化逐渐统领了美国人生活的各个领域,包括社会和政治领域。南方种植园主的贵族统治宣告结束。

美国南方遭受了巨大的破坏,随之而来的是贫困的纠缠。 重建期间铁路建设获得了大量的补贴(同时腐败现象也很严重),但南方地区保持了其棉花生产的独立性。曾经的奴隶转变成了受雇劳工或佃农。随着人口增长超过了经济的发展速度,很多潦倒的白人也加入了雇佣工人的行列。到1940年,卡罗莱纳州的纺织厂,和阿拉巴马州的钢铁企业,成为了少数起重大作用的制造行业。

Steel workers in 1905, Meadville PA南北战争结束之后迅速发展的美国经济奠定了现代美国工业的基础。1880年代,美国超越英国成为经济最发达的国家。

An explosion of new discoveries and inventions took place, causing such profound changes that some termed the results a "Second Industrial Revolution." Oil was discovered in western Pennsylvania. Refrigeration railroad cars came into use. The telephone, phonograph, typewriter and electric light were invented.20世界末期,汽车取代了四轮马车作运输工具。

Parallel to these achievements was the development of the nation's industrial infrastructure. Coal was found in abundance in the Appalachian Mountains from Pennsylvania south to Kentucky. Large iron mines opened in the Lake Superior region of the upper Midwest. Steel mills thrived in places where these two important raw materials could be brought together to produce steel. Large copper and silver mines opened, followed by lead mines and cement factories.

As industry grew larger, it developed mass-production methods. Frederick W. Taylor pioneered the field of scientific management in the late 19th century, carefully plotting the functions of various workers and then devising new, more efficient ways for them to do their jobs. Also fueling mass production was the increase in efficiency due to the electrification of factories from steam power to electric power. Electric line shafts and electric group drives improved efficiency through reduced energy loss, improved work environment, reduction in fire hazards and ability to reorganize factories into specialized departments. (True mass production was the inspiration of Henry Ford, who in 1913 adopted the moving assembly line, with each worker doing one simple task in the production of automobiles. In what turned out to be a farsighted action, Ford offered a very generous wage—$5 a day—to his workers, enabling many of them to buy the automobiles they made, helping the industry to expand.)

1904年的漫画,题为“下一个!”,把标准石油公司描绘成了一个无情的章鱼The "Gilded Age" of the second half of the 19th century was the epoch of tycoons. Many Americans came to idealize these businessmen who amassed vast financial empires. Often their success lay in seeing the long-range potential for a new service or product, as John D. Rockefeller did with oil. They were fierce competitors, single-minded in their pursuit of financial success and power. Other giants in addition to Rockefeller and Ford included Jay Gould, who made his money in railroads; J. Pierpont Morgan, banking; and Andrew Carnegie, steel. Some tycoons were honest according to business standards of their day; others, however, used force, bribery, and guile to achieve their wealth and power. For better or worse, business interests acquired significant influence over government.

Morgan, perhaps the most flamboyant of the entrepreneurs, operated on a grand scale in both his private and business life. He and his companions gambled, sailed yachts, gave lavish parties, built palatial homes, and bought European art treasures. In contrast, men such as Rockefeller and Ford exhibited puritanical qualities. They retained small-town values and lifestyles. As church-goers, they felt a sense of responsibility to others. They believed that personal virtues could bring success; theirs was the gospel of work and thrift. Later their heirs would establish the largest philanthropic foundations in America.

While upper-class European intellectuals generally looked on commerce with disdain, most Americans—living in a society with a more fluid class structure—enthusiastically embraced the idea of moneymaking. They enjoyed the risk and excitement of business enterprise, as well as the higher living standards and potential rewards of power and acclaim that business success brought.

为争取八小时工作日的游行,纽约(1871)

一幅政治漫画,描绘威尔逊总统使用关税,货币和反托拉斯法律灌注水泵,使经济运转。从传统上说,美国政府领导人大多不愿意让联邦政府过多干预私人企业,但运输部门除外。一般情况下,他们认可自由放任(laissez-faire)的理念,反对政府干预经济,认为政府对经济的干预仅限于执法、维持秩序。到了19世纪后期,当小企业、农场和劳工运动要求政府出面为他们调停时,这种态度才开始变化。

The American labor movement began with the first significant labor union, the Knights of Labor in 1867. The group helped begin the movement to end child labor, have an eight-hour workday, and use collective bargaining to help improve workers' lots.

A popular movement formed in the agricultural sector at the same time. The Grange movement, also founded in 1867, was a group of farmers who banded together to fight railroad monopolies that hurt grain shipping and to protect other farming interests.

By the turn of the century, a middle class had developed that was leery of both the business elite and the somewhat radical political movements of farmers and laborers in the Midwest and West. Known as Progressives, these people favored government regulation of business practices to, in their minds, ensure competition and free enterprise.

Congress enacted a law regulating railroads in 1887 (the Interstate Commerce Act), and one preventing large firms from controlling a single industry in 1890 (the Sherman Antitrust Act). These laws were not rigorously enforced, however, until the years between 1900 and 1920, when Republican President Theodore Roosevelt (1901–1909), Democratic President Woodrow Wilson (1913–1921), and others sympathetic to the views of the Progressives came to power. Many of today's U.S. regulatory agencies were created during these years, including the Interstate Commerce Commission and the Federal Trade Commission.

Muckrakers also had a big impact on increasing regulation of American business. Upton Sinclair's The Jungle (1906) showed America what life was like in the Chicago Union Stock Yards, a giant complex of meat processing that developed in the 1870s. The federal government responded to Sinclair's book with the new regulatory Food and Drug Administration. Ida M. Tarbell wrote a series of articles against the Standard Oil monopoly. The series helped pave the way for the breakup of the monopoly.

When Democrat Woodrow Wilson was elected President with a Democratic Congress in 1912 he implemented a series of progressive policies. In 1913, the Sixteenth Amendment was ratified, and the income tax was instituted in the United States. While public spending as a percent of GDP had declined during the Taft Administration, it began to rise under Wilson's leadership in a trend that would continue for many decades. Wilson created the Federal Reserve, a complex business-government partnership that created the first central bank since 1836. The departure of working men to serve in the armed forces was a significant blow to the workforce, and many women gained employment during the war.

1920年,人们填报纳税单主条目:咆哮的二十年代

共和党总统沃伦·G·哈定 (Warren G. Harding) 提倡“回归常态”(normalcy) ,给战时的高税率画上了句号。在他的领导下,财政部长安德鲁·W·梅隆 (Andrew Mellon) 提高关税,并降低其他税率,在1920到1930期间用大量政府盈余减少了大约1/3的联邦贷款。商务部长赫伯特·胡佛 (Herbert Hoover) 通过治理商业活动,致力于提高效率。这个时期的经济繁荣和文化发展,被称为咆哮的二十年代。快速增长的汽车业刺激了石油,玻璃和公路等行业的发展。旅游业激增,有车族购物有了更大的活动范围。小城市蓬勃发展,大城市由于商务楼,工厂以及住宅的大量建造,迎来了最辉煌的10年。新兴电力行业给商业和日常生活带来了变革。电话和电线普及到了农村,但是农民没有能够从战时土地价格泡沫中恢复过来。上百万的农民迁徙到附近的城市。然而,1929年十月,股市崩盘,银行倒闭。

主条目:美国经济大萧条

1929年崩盘以后的证券交易市场

住在加利福尼亚州的一辆卡车上的密苏里州移民,大萧条期间很多无家可归的人去加利福尼亚州找工作。The Federal Reserve Board chose to stand by, leaving interest rates high and not shoring up banks, while Congress expanded government in an effort to alleviate the recession. There was a sharp drop in the money supply, which would amount to a one-third reduction by 1933. President Herbert Hoover passed a massive tax increase to boost sagging federal revenues, and signed the protectionist Smoot-Hawley Tariff, which incited retaliation by Canada, Britain, Germany and other trading partners. The U.S. economy plunged into depression. By 1932, the unemployment rate was 23.6%. Conditions were worse in heavy industry, lumbering, export agriculture (cotton, wheat, tobacco), and mining. Conditions were not quite as bad in white collar sectors and in light manufacturing.

Franklin Delano Roosevelt was elected President in 1932 without a specific program. He relied on a highly eclectic group of advisors who patched together many programs, known as the New Deal.

Government spending increased from 8.0% of GNP under Hoover in 1932 to 10.2% of GNP in 1936. While Roosevelt balanced the "regular" budget the emergency budget was funded by debt, which increased from 33.6% of GNP in 1932 to 40.9% in 1936.[2] Deficit spending had been recommended by some economists, most notably John Maynard Keynes in Britain. Roosevelt met Keynes but did not pay attention to his recommendations. After a meeting with Keynes, who kept drawing diagrams, Roosevelt remarked that "He must be a mathematician rather than a political economist."

The extent to which the spending for relief and public works provided a sufficient stimulus to revive the U.S. economy, or whether it harmed the economy, is also debated. If one defines economic health entirely by the gross domestic product, the U.S. had gotten back on track by 1934, and made a full recovery by 1936, but as Roosevelt said, one third of the nation was ill fed, ill-housed and ill-clothed. See Chart 3. GNP was 34% higher in 1936 than 1932, and 58% higher in 1940 on the eve of war. The economy grew 58% from 1932 to 1940 in 8 years of peacetime, and then grew 56% from 1940 to 1945 in 5 years of wartime. However, the unemployment rate never went below 9% before the draft. During the war the economy operated under so many different conditions that comparison is impossible with peacetime, such as massive spending, price controls, bond campaigns, controls over raw materials, prohibitions on new housing and new automobiles, rationing, guaranteed cost-plus profits, subsidized wages, and the draft of 12 million soldiers.

此条目的中立性有争议。内容、语调可能带有明显的个人观点或地方色彩。(2007年12月)

加上此模板的编辑者需在讨论页说明此文中立性有争议的原因,以便让各编辑者讨论和改善。

在编辑之前请务必察看讨论页。

1942年,妇女为战争制造铝制弹壳战时生产局负责协调整个国家的生产力,以优先满足军事需要。许多生产消费品的工厂转而为军事服务。汽车制造商开始制造飞机和坦克,把美国变成了“民主武器库”(arsenal of democracy)。随着国家收入的增加以及消费品变得稀缺,政府建立了价格管理局,来防止通货膨胀。价格管理局主要通过控制一些地区的租金,和一些普通消费品,例如糖,石油等;以此控制价格上涨。

1940年代早期,受益于二战的影响,美国成功摆脱了大萧条的阴影。但也有政治评论说弗兰克林·罗斯福的社会民主政策对此也有贡献,但批评说罗斯福的政策阻碍了经济复苏,甚至让情况变得更坏。但至少经济的复苏,有部分是因为其自我恢复的特性;大萧条是美国历史上第六次衰退。华尔街在战后享受了历史上最长的一次牛市,股市几乎毫无阻力的从1949年到一直上涨到1957年。美国政府当时参与社会福利和被艾森豪威尔称为军事工业复合体的政策一直延续至今。

6百万妇女开始参与生产制造业的工作;这些临时工作大部分都是制造弹药。她们部分替代了男人在军事中的位置。这些女工们被抽象成小说中的人物,女子铆钉工。战后,随着男人们回到家乡,很多妇女停止工作回到了家中。但二战中使用女工的先例,为以后让妇女加入美国劳动大军铺平了道路。

The period from the end of World War II to the early 1970s was a golden era of American capitalism.

The Council of Economic Advisers was established by the Employment Act of 1946 to provide objective economic analysis and advice on the development and implementation of a wide range of domestic and international economic policy issues. In its first 7 years the CEA made five technical advances in policy making:[来源请求]

the replacement of a "cyclical model" of the economy by a "growth model,"

the setting of quantitative targets for the economy,

use of the theories of fiscal drag and full-employment budget,

recognition of the need for greater flexibility in taxation, and

replacement of the notion of unemployment as a structural problem by a realization of a low aggregate demand.

In 1949 a dispute broke out between chairman Edwin Nourse and member Leon Keyserling. Nourse believed a choice had to be made between "guns or butter" but Keyserling argued that an expanding economy permitted large defense expenditures without sacrificing an increased standard of living. In 1949 Keyserling gained support from powerful Truman advisers Dean Acheson and Clark Clifford. Nourse resigned as chairman, warning about the dangers of budget deficits and increased funding of "wasteful" defense costs. Keyserling succeeded to the chairmanship and influenced Truman's Fair Deal proposals and the economic sections of National Security Council Resolution 68 that, in April 1950, asserted that the larger armed forces America needed would not affect living standards or risk the "transformation of the free character of our economy."

During the 1953–54 recession, the CEA, headed by Arthur Burns deployed traditional Republican rhetoric. However it supported an activist contracyclical approach that helped to establish Keynesianism as a bipartisan economic policy for the nation. Especially important in formulating the CEA response to the recession—accelerating public works programs, easing credit, and reducing taxes—were Arthur F. Burns and Neil H. Jacoby.

President John F. Kennedy passed the largest tax cut in history upon entering office in 1961. $200 billion in war bonds matured, and the G.I. Bill financed a well-educated work force. The middle class swelled, as did GDP and productivity. The U.S. underwent a kind of golden age of economic growth. This growth was distributed fairly evenly across the economic classes, which some attribute to the strength of labor unions in this period—labor union membership peaked historically in the U.S. during the 1950s, in the midst of this massive economic growth. President Lyndon B. Johnson (1963–69) dreamed of creating a "Great Society", and began many new social programs to that end, such as Medicaid and Medicare. The government financed some of private industry's research and development throughout these decades, most notably ARPANET (which would become the Internet).

In the late 1960s it was apparent to some that this juggernaut of economic growth was slowing down, and it began to become visibly apparent in the early 1970s. Stagflation gripped the nation, and the government experimented with wage and price controls under President Nixon. The Bretton Woods Agreement collapsed in 1971–1972, and President Nixon closed the gold window at the Federal Reserve, taking the United States entirely off the gold standard. President Gerald Ford introduced the slogan, "Whip Inflation Now" (WIN). In 1974, productivity shrunk by 1.5%, though this soon recovered. In 1976, Jimmy Carter won the Presidency. Carter would later take much of the blame for the even more turbulent economic times to come, though some say circumstances were outside his control. Inflation continued to climb skyward. Productivity growth was pitiful, when not negative. Interest rates remained high, with the prime reaching 20% in January 1981; Art Buchwald quipped that 1980 would go down in history as the year when it was cheaper to borrow money from the Mafia than the local bank.

从1975年到1979年,失业率总体上稳定下降,但不久后开始陡然升高。

This period also saw the increased rise of the environmental and consumer movements, and the government established new regulations and regulatory agencies such as the Occupational Safety and Health Administration, the Consumer Product Safety Commission, the Nuclear Regulatory Commission, and others.

The deregulation movement began when Nixon left office and was a bipartisan operation under Ford, Carter and Reagan. Most important were the removals of New Deal regulations from energy, communications, transportation and banking. The hasty removal of regulation of Savings and Loans while keeping federal insurance led to the Savings and Loan crisis which cost the government an estimated $160 billion.

In 1981, Ronald Reagan introduced fiscally-expansive economic policies, cutting marginal federal income tax rates by 25%. Inflation dropped dramatically from 13.5% annually in 1980 to just 3% annually in 1983 due to a short recession and the Federal Reserve Chairman Paul Volker's tighter control of the money supply and interest rates. Real GDP began to grow after contracting in 1980 and 1982. The unemployment rate continued to rise to a peak of 10.8% by late 1982, but then dropped as sharply as it had risen to a level of 5.4% at the end of Reagan's presidency in January 1989. Critics of the Reagan Administration often point to the fact that the gap between those in the upper socioeconomic levels and those in the lower socioeconomic levels increased during Reagan's presidency; they also note that the federal debt spawned by his policies tripled (from $930 billion on December 31, 1981 to $2.6 trillion on September 30, 1988), reaching record levels. Every president in the later half of the 20th century before Reagan reduced debt as a share of GDP. In addition to the fiscal deficits, the U.S. started to have large trade deficits. Also it was during his second term that the Tax Reform Act of 1986 was passed. In 1987, the stock market lost 22% of its value on Black Monday, although it is debated over how much (if any) of Reagan's policies had an effect on this. Vice President George H. W. Bush was elected to succeed Reagan as Commander-In-Chief in 1988. The early Bush Presidency's economic policies were essentially a continuation of Reagan's policies, but in the early 1990s, Bush went back on a promise and increased taxes in a compromise with Congressional Democrats. He ended his presidency on a moderate note, signing regulatory bills such as the Americans With Disabilities Act, a mandate stating that toilets use low amounts of water, and negotiating the North American Free Trade Agreement. In 1992, Bush and third-party candidate Ross Perot lost to Democrat Bill Clinton.

The advent of deindustrialization in the late 1960s and early 1970s saw income inequality increase dramatically to levels never seen before. In 1968, the U.S.' Gini coefficient was 0.386, about equivalent to that of contemporary Portugal (38.5) and Japan (38.1), though still above that of the United Kingdom (36.8) and Canada (33.1). However, in the years since deregulation and globalization have allowed U.S. companies to begin to shift their manufacturing and heavy industrial operations to second- and third-world countries with lower labor costs, income inequality in the U.S. has risen dramatically. In 2005, the American Gini coefficient had reached 0.469, similar to that of Malaysia and the Philippines, both at 46.1, and well-ahead of China (44.0). Critics of economic policies favored by Republican and Democratic administrations since the 1960s, particularly those expanding "free trade" and "open markets" say that these policies, though benefiting other nations as well as the cost of products in the U.S., have taken their own heavy toll on the prosperity of the American middle-class.

20世纪90年代,国债增长75%,GDP增长69%,标准普尔500指数增长超过3倍。

1994年到2000年期间,实际产出增长,伴随着温和的通货膨胀以及不到5%的失业率,随之而来的是暴涨的股票市场,以及互联网繁荣。90年代后期市场的热点是高科技的首次公开发行和互联网公司。然而到了2000年,股票估值产生泡沫,从2000年3月,市场开始释放出90年代大约50%到75%的增长。2001年经济恶化,国民产出只增长0.3%,但失业率和破产数量都大幅上升,带来了21世纪初的衰退,但人们常常把这次衰退归咎于九一一恐怖袭击。

^ Digital History

^ Historical Statistics (1976) series Y457, Y493, F32

^ based on data in Susan Carter, ed. Historical Statistics of the US: Millennial Edition (2006) series Ca9

^ Mitchell p 404

^ http://research.stlouisfed.org/fred2/data/INDPRO.txt

^ Source GNP: U.S. Dept of Commerce, National Income and Product Accounts [1]; Mitchell 446, 449, 451; Money supply M2

^ GDP (nominal and adjusted) qfigures from 1929 to present are from the Bureau of Economic Analysis.

Figures for before 1929 have been reconstructed by Johnston and Williamson based on various sources and are less reliable. See http://eh.net/hmit/gdp/GDPsource.htm for more information about sources and methods.

Current-dollar and real GDP. United States Bureau of Economic Analysis. 20 Dec 2007

Louis D. Johnston and Samuel H. Williamson, "The Annual Real and Nominal GDP for the United States, 1790 – Present." Economic History Services, July 27, 2007, URL : http://eh.net/hmit/gdp/

Inflation-adjusted figures are for base year 2000

This article contains public domain text from the United States Department of State from State.gov

Andreano, Ralph, ed. The Economic Impact of the Civil War (1962), articles

Atack, Jeremy and Peter Passell. A New Economic View of American History: From Colonial Times to 1940 (1994) online, 1st edition was Lee, Susan Previant, and Peter Passell. A New Economic View of American History (1979)

Carter, Susan B., Scott Sigmund Gartner, Michael R. Haines, and Alan L. Olmstead, eds. The Historical Statistics of the United States (Cambridge University Press: 6 vol 2006); online (in Excel format) at some universities. 37,000 data sets make it the standard data source for all topics

Chandler, Alfred D. The Visible Hand: The Managerial Revolution in American Business (1977), business history

Chandler, Alfred D.; Strategy and Structure: Chapters in the History of the Industrial Enterprise (1969) online

Chandler, Alfred D. and James W. Cortada. A Nation Transformed by Information: How Information Has Shaped the United States from Colonial Times to the Present (2000) online

Cochran; Thomas C. 200 Years of American Business. (1977) online

Devine, Warren D. Jr. "From Shafts to Wire: Historical Perspective on Electrification". Journal of Economic History, Vol 43, No. 2 (June 1983) pp. 347–372.

Engerman, Stanley L. and Robert E. Gallman, eds. The Cambridge Economic History of the United States (2000), cover 1790–1914; heavily quantitative

French, Michael. US Economic History since 1945 (1997)

Goldin, Claudia Understanding the Gender Gap: An Economic History of American Women (1990), quantitative

Gordon, John Steele An Empire of Wealth: The Epic History of American Economic Power (2004), popular history

Gordon, Robert. "U.S. Economic Growth since 1870: One Big Wave," American Economic Review 89:2 (May 1999), 123–28; in JSTOR

Hughes, Jonathan and Louis P. Cain. American Economic History (6th Edition) (2002), textbook

Kirkland; Edward C. A History of American Economic Life (1951), textbook online

Mitchell, Broadus. The Depression Decade: From New Era through New Deal, 1929–1941 (1947) broad economic history of the era; online

Nettels, Curtis P. The Emergence of a National Economy, 1775–1815 (1962) broad economic history of the era

Ransom, Roger. Conflict and Compromise: The Political Economy of Slavery, Emancipation and the American Civil War (1989)

Schmidt, Louis Bernard, and Earle Dudley Ross. Readings in the Economic History of American Agriculture (1925), primary sources; online

Sellers, Charles, The Market Revolution: Jacksonian America, 1815–1846 (1994) online

Soule, George. The Prosperity Decade: From War to Depression, 1917–1929 (1947) broad economic history of decade

Studenski, Paul, and Herman Krooss. A Financial History of the United States (1952)

Taylor, George Rogers. The Transportation Revolution 1815–1860 (1962) broad economic history of the era

Temin, Peter. The Jacksonian Economy (1969) online

Walton, Gary M. and Hugh Rockoff. History of the American Economy with Economic Applications (2004), textbook

Whaples, Robert and Dianne C. Betts, eds. Historical Perspectives on the American Economy: Selected Readings (1995) articles

Wright, Gavin. Old South, New South: Revolutions in the Southern Economy since the Civil War (1986)

Wright, Gavin. The Political Economy of the Cotton South: Households, Markets, and Wealth in the Nineteenth Century (1978) online

Wright, Robert E. and David J. Cowen. Financial Founding Fathers: The Men Who Made America Rich, University of Chicago Press, 2006. ISBN 0-226-91068-7.

数据

Bureau of Economic Analysis: Official United States GDP data

US GDP 1790 to 2005, include GDP, Real GDP, population, GDP per capita, and Real GDP per capita

参看

经济大萧条与美国

美国的工人联盟

Template:经济史

附件列表

→如果您认为本词条还有待完善,请 编辑词条

词条内容仅供参考,如果您需要解决具体问题

(尤其在法律、医学等领域),建议您咨询相关领域专业人士。

0

同义词: 暂无同义词

关于本词条的评论 (共0条)发表评论>>

编辑实验

创建词条

编辑实验

创建词条